Roll has begun and we are now in October Crude (CLV12)

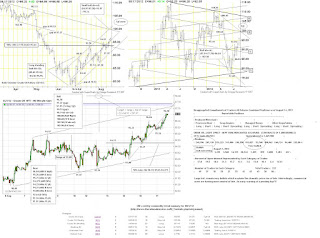

Price analysis for the week of August 17th, 2012:

Market

Overview: As the end of the summer approaches so too does Labor Day weekend. This event is often coupled with extremely low volumes with violent price action. Since September is often a poor month for asset performance, a good portion of the rally we are witnessing now (and over the coming three weeks) may be given back rather quickly once the professionals come back from their vacations.

Trading Plan for this coming week: As stated above, I shall be looking for this move to continue to the upside but do expect quick violent moves lower to try and flush out as many 'weak hands' as possible. Continue to use 'OTE' setup to identify buying and selling opportunities at key support/resistance levels on the 60m chart outlined above.

Weekly

highlight: The previously mentioned large purchases by Institutions did indeed set up the market to move higher. Additionally, the rather noticeable breakdown in the US long treasury market suggest that higher, not lower asset prices ought to be expected for at least the next little while. Good corporate earnings, good economic numbers and a friendly US Federal Reserve Board have all laid the groundwork for a significant test of the spring stock market highs and in my opinion a substantial move higher over the coming weeks/months.

Trading Strategy (1 month): The previously stated upside objective (daily bull ab=cd) has been hit and exceeded. With this target hit one ought to expect a bit of a correction but given the light volumes and seasonality, that correction ought to still be considered a buying opportunity. New Upside objectives include a small daily bull ab=cd (target of 99.74) as well as two significant gaps that ought to be filled (97.27 & 99.53). Lastly, we do have a rather noticable weekly bullish ab=cd currently working which in iteself suggests prices want to eventually move towards the 102.50 area.

Trading Plan for this coming week: As stated above, I shall be looking for this move to continue to the upside but do expect quick violent moves lower to try and flush out as many 'weak hands' as possible. Continue to use 'OTE' setup to identify buying and selling opportunities at key support/resistance levels on the 60m chart outlined above.

Focus

for the week: I am comfortable with 'OTE' trading and I want to focus this week on Trade Process goals. Additionally, a TsT adviors (Dr. Menikar) has given recruits an assignment to really explore feelings around loosing trades. How does it make me feel, what are those feelings, are they justifiable and is acting on those feelings really in my best interest.....very interesting stuff....

That's all for this post,

Brian Beamish FCSI

The Canadian Rational Investor

the_rational_investor@yahoo.com

http://www.therationalinvestor.ca

http://crisdaytrading.blogspot.ca/

Brian Beamish FCSI

The Canadian Rational Investor

the_rational_investor@yahoo.com

http://www.therationalinvestor.ca

http://crisdaytrading.blogspot.ca/

No comments:

Post a Comment